Say Goodbye to Unallocated Cash Receipts - Because No One Has Time for Accounting Mysteries

When you run any business that relies on receiving payments from customers, it's important to have a process in place for tracking those payments. This is especially true if you're dealing with unallocated cash receipts, which are payments that come in without any information about where they should be applied.

Aircraft leasing firms see their fair share of unallocated cash receipts, due to payments coming in from a variety of accounts and the payment sometimes lacking clear instructions.

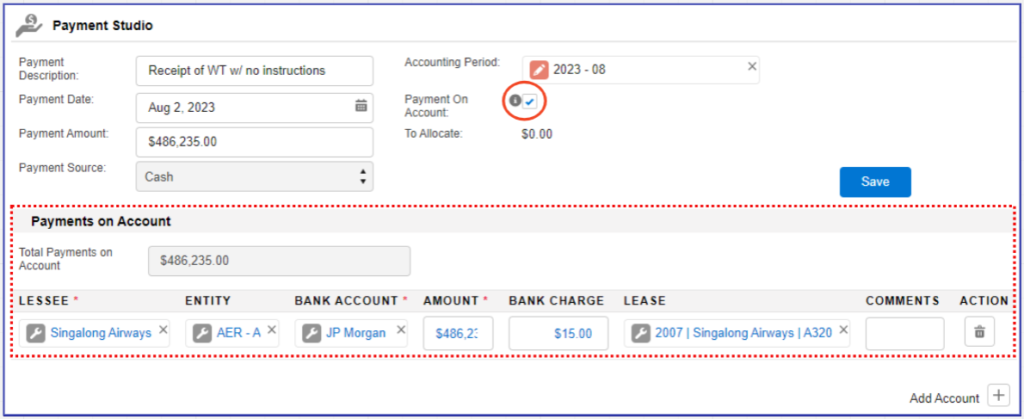

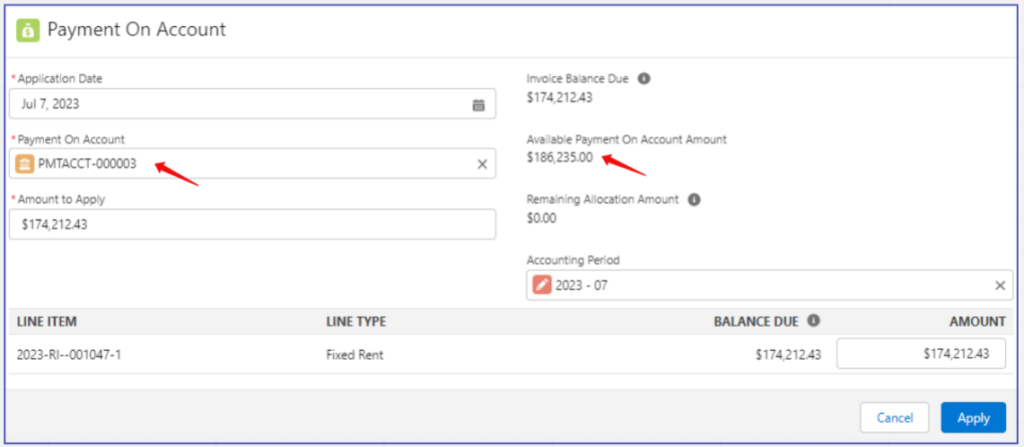

In these situations, it's essential to have a process in place for managing the unallocated cash. To help customers, LeaseWorks offers a feature called “Payment on Account”, which allows you to hold the funds and link them to the appropriate lessee or operator account.

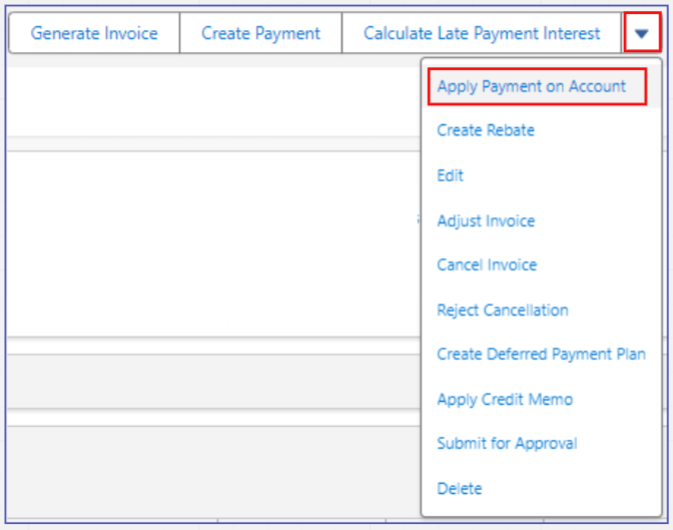

Once the allocation is completed, it's easy to categorize the allocation of funds with just a few clicks.

We keep the user experience streamlined by offering the Payment on Account feature within the same module where we normally apply cash receipts to unpaid invoices, which is the Payment Studio. The following are three benefits of using LeaseWorks to track these funds:

- Manage unallocated cash receipts digitally, rather than tracking these in an external spreadsheet.

- Track and apply allocation, ensuring that the unapplied cash balance is always updated and accurate in real time.

- Save time and reduce the risk of errors or inconsistencies in reconciling a lessee’s account by centrally recording overpayments. For example, if a lessee makes a payment that is more than the amount they owe, you can apply some of the funds to accounts receivable and record the overpayment to be held on account, all in one transaction.

In conclusion, tracking unallocated cash receipts is an important part of managing your business's finances. For aviation companies, the Payment on Account feature offered by LeaseWorks provides a simple and efficient way to manage unapplied funds. By using this feature, you can ensure that your finance records are accurate and up to date, saving time and reducing the risk of errors.

Diane Heron

Customer Success Manager